[KPMG Football Benchmark’s business intelligence tool standardizes and consolidates the financial, operational and social media data of hundreds of professional football clubs]

The current football landscape represents a very interesting time for football sponsorship, perhaps the most stimulating time in its history, one rich with opportunity, risk and challenge in equal measure. The current Covid-19 global pandemic will no doubt pass in time, but its effects are also currently being felt across the football industry and many sectors of the global economy and likely to be felt for a very long time. It has an impact on sponsorship exposure and effectiveness – for some brands, that led to an immediate re-evaluation and even cessation of their commitments in some cases. Nevertheless, according to KPMG Football Benchmark the total value of sponsorship across the big five leagues in 2020 is more than EUR 3.3 bn p/a, with front-of-shirt sponsorship representing almost a third of this figure.

Where has this recent growth come from, how has the football sponsorship industry evolved and where is it heading considering the current humanitarian and economic climate? In this article, the KPMG Football Benchmark explores the football sponsorship industry, analysing the key trends driving growth, while in a following separate article, will overview the key players of the market. From its widely regarded origins in 1950’s Uruguayan professional football, the football sponsorship industry and the values attached to it have seen exponential growth. The corporate world has increasingly found sports and in particular, the football industry attractive from a sponsorship perspective thanks to the global popularity of the game and the unrivalled power football has in raising brand visibility, creating positive associations between the team, league or player and the corporate brand and providing amplified brand differentiation from their competitors within a cluttered advertising landscape.

Football fans now want to be closer to the action, to the players, and to see the most revealing camera angles across their chosen broadcast medium. The evolving media landscape and innovative technology that enables this level of experience and engagement have provided a rich array of sponsorship activation opportunities for brands to capitalise on to appeal to fans in a way that deepens relationships far beyond a logo impression.

Globalisation, digitalisation and a developing media landscape have changed the face of top-tier football sponsorship, creating new and exciting strategic and commercial opportunities for football clubs, players and corporate sponsors alike. At the same time, many challenges for both rights-holder and sponsors have presented themselves as they try to adapt, keep pace with and capitalise on the changes in the quest for competitive advantage.

Top-level professional football has evolved to become a truly global entertainment industry, full of brands that transcend nationality, gender and demographics. The top five football leagues now broadcast into unparalleled 212 territories across the world and according to industry reports football is the most widely watched sport in all regions globally except for North America, where it is fourth behind the three big US codes. The highest level of football viewing is seen in the Middle East & Africa and Latin America, both sharing 72% of the population who say they regularly watch football online or via broadcast TV.

Other studies also show that the UAE, followed by Thailand have the highest rates of interest in football at a national level with 80% and 78% of the population respectively. However, most fans are interested in high-quality entertainment and thus gravitate towards football’s top products, typically the larger leagues of Europe, the World Cup or the UEFA Champions League.

It is now not uncommon for major clubs to have 80-90% of their fan base located abroad, often on other continents. In fact, it is likely that right at this present time a young boy is walking down the streets of Mumbai wearing a Liverpool FC or Real Madrid shirt.

This demonstrates how far top-level football has evolved away from its core fan base in home markets to new football frontiers and cultures where fans often have different attitudes and exhibit different behaviours towards their club in terms of engagement and consumption. This has presented fascinating new opportunities for leading clubs and international brands alike to capitalise on this unparalleled level of popularity, diversity of exposure and insatiable fan appetite for live games and other content relating to the team almost 24/7.

The development of existing and new media channels has also made football more accessible to more people at a lower cost on a global scale and has changed the consumption habits of fans. As a result, many football clubs have transformed from simple sporting entities into leisure & media corporations competing for the leisure time and attention of fans/consumers on a global scale, creating a hugely valuable sponsorship opportunity for leading corporate brands.

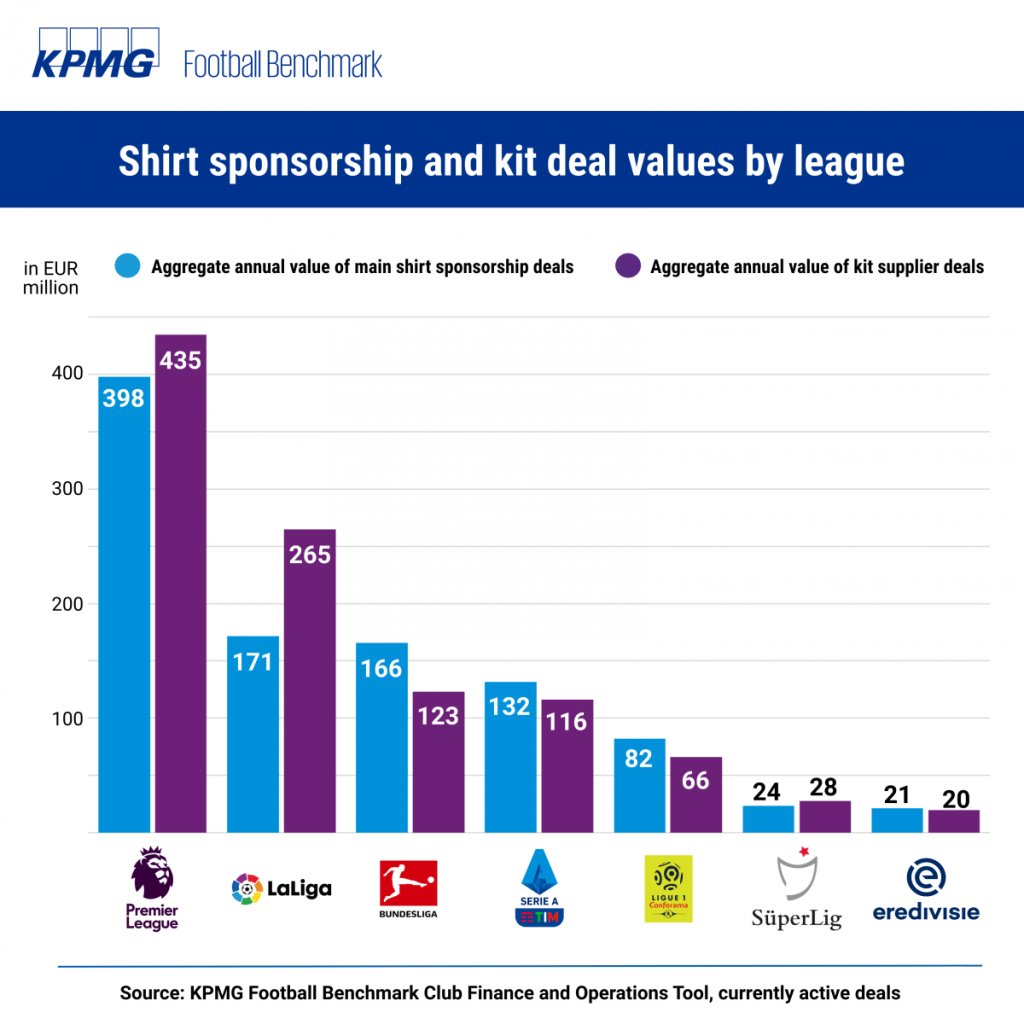

The top five global football leagues reign supreme, attracting sponsorship value far in excess to other leagues internationally due to their superior global appeal. According to KPMG Football Benchmark, within the top five leagues, the Premier League generates annually EUR 832 million in front-of-shirt and kit sponsorship income, almost double its nearest rival LaLiga at EUR 436 million p/a.

However, the relative on-field success and commercial power retained by only a small number of elite clubs have driven polarisation within these respective leagues – for instance, the big six clubs of the Premier League account for a staggering 83% of the total annual shirt and kit sponsorship value captured across the league and the two powerhouses of LaLiga, Barcelona and Real Madrid collectively account for 80% of the total shirt and kit value generated across LaLiga.

The financial might and marketability of the big five leagues and superior attraction they have to sponsors are even more prominent when comparing them with other top tier international leagues. Despite the strong and impassioned local support of clubs from Turkey’s Süper Lig, for instance, the combined shirt and kit sponsorship is EUR 52 million p/a, little more than the fee Etihad pays Manchester City to place its name on the shirt. But this is of little surprise considering the gulf in international brand profile and appeal compared to the top five leagues. The USA as a relatively new frontier for modern football is seeing popularity in football thrive. The national MLS league has been growing at an unprecedented pace over the last few years, with team participation more than doubling from 12 on inception to the current 26 clubs including the addition of Inter Miami CF and Nashville SC the most recent inclusions. The growing profile of the MLS domestically and in other key markets such as Mexico and Canada, combined with the strong investment in club infrastructure and the continued influx of foreign ‘marque players’ has seen commercial opportunities and income thrive across the league over recent years. US brands are increasingly attracted to the MLS where the average front of shirt deal value is on par with some of Europe’s top tier leagues such as Portugal’s Primeira Liga and the Russian Premier League.

A new globally diverse fan base has opened opportunities for international brands looking to leverage the profile, appeal and brand equity of leading football clubs. The growing reach and depth of Middle Eastern investment in top-level football around the world show no sign of any slowdown. Middle Eastern brands have increasingly turned to some of the most prominent football clubs for sponsorship opportunities as the region and many of its brands continue to pursue greater acceptance, relevance and economic value from the wider global economy. According to KPMG Football Benchmark, the Middle East represents the largest sponsorship investor into topflight football at EUR 200m p/a with some of the largest European clubs now lucratively sponsored by the big three Middle East airlines.

Emerging trends

As top-level professional football has become a global entertainment industry, it is increasingly attracting lifestyle and luxury brand components. Take the EUR 25 million p/a kit deal between PSG and Brand ‘Jordan’. A well thought through partnership that clearly capitalises on shared brand synergies to engage with new customers and fans from not only within football but from the world of fashion and other sports. Through the use of various digital platforms, high-profile influencers and celebrity endorsements (including Neymar and Mbappe), PSG have been able to drive brand awareness, brand equity and shirt sales globally, selling 1m shirts in 2019, making it the fifth most popular football shirt globally.

As the PSG case demonstrates, developments in digitalisation and the media landscape has provided greater means for clubs and sponsor brands alike to broaden their reach to fans and customers far beyond the playing stadium. However, globalisation of the game is perhaps most apparent in the fanbase composition of the biggest clubs which is often dominated by supporters from all around the world with local fans representing only a minority creating fragmented access to different types of branded content globally. This has led to a degree of uncertainty for brands when allocating activation budget against the various channels and platforms whilst maintaining brand authenticity. Equally, it has become increasingly important for clubs to leverage all the new digital capabilities in a hyper-connected digital world, but with a better understanding of fan segmentation in order to maximise sponsorship content, authenticity and therefore effectiveness.

The growth of women’s football globally and the investment in ladies’ teams by leading football clubs have presented new commercial and sponsorship opportunities for clubs and sponsor brands alike. The USA has undoubtedly been at the forefront of development within women’s football, but the success of the most recent world cup seems to have been pivotal in promoting the game globally. The likes of Manchester United, Tottenham Hotspur and more recently Real Madrid launched their very own ladies’ teams. Amongst many motivations for doing so has been the commercial case it presents. For example, closer ties are being created between the men’s and ladies’ teams of Manchester City FC. To not only help promote and support the ladies’ team, but provide new marketing, content and activations opportunities for the club and sponsors.

A number of leading brands have identified the opportunity to enter women’s football to take advantage of a relatively uncluttered sponsorship landscape when compared to the men’s game. Sponsorship of women’s football also offers many brands exposure to an audience of young ambitious females who may have been unreachable through the men’s game. By getting into these channels early, sponsors are able to better understand their audience and tailor their messages accordingly. Barclays, long associated with the English Premier League agreed on a multi-million sponsorship deal with the English Football Association Women’s Super League (FA WSL) from the start of the 2019/20 season. At the end of 2018, Visa also signed a significant seven-year women’s football deal with Uefa. Both brands with legacies in football sponsorship have clearly identified the opportunity capitalize commercially on the strong participation, support and growth of the ladies game internationally, whilst providing innovative and memorable experiences across their respective competitions to inspire the next generation of fans of the women’s game. Deals of this nature confirm the commercial landscape of the women’s game has shifted dramatically over the past few years.

The relevance of social media is also fast emerging – although “page likes” do not necessarily translate into revenues for a club, the number of followers on these platforms can still be treated as a metric of relative popularity and within the sponsorship evaluation criteria. Sponsor brands are looking at club and player popularity amongst an established audience to inform who to sign commercial agreements with, also appreciating the opportunities to communicate with increasingly upwardly mobile fans across many platforms and in tune with their club engagement habits.

For instance, a typically younger demographic can be watching a match in the stadium while commenting and sharing content through digital platforms. Therefore, for a sponsor, it is not only important to be present on what fans are seeing or watching (the match itself) but also on what they are sharing in order to gain exposure more efficiently. Many top clubs provide sponsors with a vast global online community to leverage as part of its sponsorship activation programme. According to KPMG Football Benchmark, Real Madrid CF has 240m followers across all social media platforms.

However, social media is not a playground exclusive to clubs; players can also utilise it to increase their profile, generate commercial revenues and stay in touch (indirectly) with their fans. Interestingly in many instances, players have more followers than their teams. The most extreme example is Cristiano Ronaldo, who is followed by almost five times as many people as Juventus FC according to KPMG Football Benchmark.

The ongoing Covid-19 pandemic has had an unprecedented effect on global football. As many professional football leagues race to complete the current season in stadiums reserved for players and staff only and in many cases to the sound of artificial crowd noise and cheer, clubs are figuring out how to best navigate the short and long terms effects to their businesses including how to keep sponsors on board and happy.

Most sponsor brands have not pulled out of their sponsorship deal commitments. If they had, it would have been an extremely short-sighted view and one that would have probably caused greater brand equity and value damage compared to the cost-saving over the short term. A sponsor pulling out of a deal would likely live long in the memory of club fans and possibly nonfans, much to the brand’s detriment.

Nevertheless, and similarly to broadcast media partners, sponsors are very likely to sit down with right-holders to discuss payment terms and potentially renegotiate the financials of the agreements in place, leaving clubs severely hit by the situation. Furthermore, the vast majority of clubs do not enjoy long-term agreements with their partner brands. With many industries likely undergoing economic difficulties in the near future, this will cast further doubts on the viability of the commercial income stream. Simply put, many brands could think twice before committing to a major sponsorship deal, particularly if one considers that the airlines, automotive and retail sectors are such strong investors into world football.

With no live football, or games played behind closed doors, sponsorship activations have certainly become harder to implement. Sponsors have looked for innovative ways to ensure they get some ROI by recalibrating campaigns and assets to achieve some engagement and connection with fans, mostly on digital platforms. One successful platform has been esports. Prior to many leagues restarting, many football leagues around the world scrambled to arrange esports versions of their respective competitions. The Premier League for example hosted an EA sports invitational whereby prominent players in the league participated in games of FIFA20 which were then broadcasted via the EPL website, as well as Sky Sports in the UK. This raises the question of the appetite of clubs to pursue esports as a viable source of revenue in the future.

In fact, many players have used the lockdown to build their own brands and social media followings, spending more time engaging with fans in different ways such as;esports competitions, which has created new and exciting content and is reaching new audiences. Sergio Aguero, of Manchester City, for instance, has successfully developed his personal brand and social media following during the crisis through esports. This is positive news for sponsors and commercial partners associated with Sergio who have maintained some degree of exposure over these channels.

Football sponsorship investment has seen considerable growth, but so too has the actual and perceived value to sponsors. It is yet to be seen, how this trend evolves due to recent events and the observed impact the coronavirus has had on the game, clubs and the overarching economy at large. But one thing is for sure, brands will be paying very close attention to their sponsorship investments, the risks and the realised returns. Likewise, there is a heightened requirement for clubs to be able to demonstrate the value as a rights-holder relative to their peers.

PREFERRED CITATION – The changing face of football sponsorship – key trends, KPMG FOOTBALL BENCHMARK, https://footballbenchmark.com/library/the_changing_face_of_football_sponsorship_key_trends.

Leave a comment